The progression of technology, from the massive mainframes of the late 19th to early 20th century that occupied entire rooms, to the present-day palm-sized computers and smart-devices, is remarkable. Modern internet-enabled devices, operating in a cloud environment-like smartphones-empower us to lead dynamic lives. This technological evolution has significantly impacted various business activities, including but not limited to gaming, food ordering, online shopping, multimedia streaming, Online payment, real-time logistics services, and more.

The convergence of these technologies has become inevitable, and many highly successful larger companies strategically allocate resources to shape their future. This involves adopting both capital expenditure in physical network offices, inter-office technology, and including cross-border currency swap payment solutions for their customers. As a result, most Small and Medium Enterprises (SMEs) face difficulties competing with well-funded larger companies. However, in the face of a rapidly changing business environment with technological innovation, the chances to compete with larger companies and offer similar or even better services are achievable.

In contrast to larger corporations, Small and Medium Enterprises (SMEs) often grapple with limited budgets, knowledges and time constraints, need to adjust too. The world economic has shifted away from traditional method, the ability to adopt and to progress in technological transformations is key survivor. Hiring a dedicated expert is frequently beyond SMEs financial reaches, especially when many consultants require substantial upfront fees for solutions that could, in reality, be procured at a fraction of the cost.

When venturing into technology, it’s worth considering alternative strategies. Forming partnerships with an upstart technology company that is eager to advance, specializes in, and has already developed applications proves more practical for SMEs than attempting a solo endeavor. SMEs can realize significant advantages by opting for technology solutions with comprehensive platform supply chain capabilities, including an online payment gateway. By collaborating and cooperating with like-minded companies, each SME has the opportunity to access an even greater variety of services and payment features.

SMEs can realize significant advantages by opting for technology solutions with comprehensive platform supply chain capabilities, including an online payment gateway. By collaborating and cooperating with like-minded companies, each SME has the opportunity to access an even greater variety of services and payment features.

The availability of a payment gateway is as crucial as the business itself, providing flexibility and creative options for managing cross-border transactions and cash flow. The payment gateway operates in each country, offering a variety of payment options, including exchange rates at the agreed-upon transaction, linked to major online currency platforms. Furthermore, a localized payment gateway ensures compliance with each country’s financial regulations.

Furthermore, a localized payment gateway ensures compliance with each country’s financial regulations.

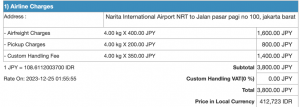

For high-risk users, especially in a B2C (Business to Consumer) segment, offering online payments, such as QR payments popular in many countries, is a preferable option. It minimizes bank charges and risks compared to typical credit card or payment terms. After successful payment, the system will issue detailed invoices for each transaction, including exchange rates at the agreed time and descriptions of each service, distributed to both origin and destination participants. Consolidated payments will then be issued to each partner within a timely period by the platform provider.

Collaborating collectively with technology providers and SME users presents a better opportunity to compete with competitors. It facilitates improved sharing of operating costs, closer collaboration, and a larger operating network. This shift, known as working together smartly rather than working alone harder. The transformation from human-centric to algorithm processes is not dehumanizing: instead, it emphasizes efficiency and effectiveness to align with the demands of the modern era, reducing bottlenecks, speeding up responses, enhancing control over the payment process, and minimizing human errors.

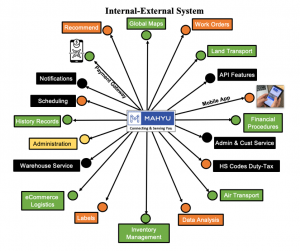

The transformation involves structuring an interconnected chain of internal and external systems with online payment for both B2B and B2C, is the next frontier for the logistics and supply chain industry. With a more diverse range of users involved in the industry, along with real-time data sources and analytical algorithms, the industry now has the option to adapt a real-time work method. Shippers and their counterparts, who have traditionally spent considerable time waiting for payment reports, update statuses, or quotes that typically take days, can now access and view this information directly delivered to their devices in real-time.

With a more diverse range of users involved in the industry, along with real-time data sources and analytical algorithms, the industry now has the option to adapt a real-time work method. Shippers and their counterparts, who have traditionally spent considerable time waiting for payment reports, update statuses, or quotes that typically take days, can now access and view this information directly delivered to their devices in real-time.

These new experiences of working in real-time, whether from smart devices or laptops, is now accessible to many logistics platform users who have long been accustomed to decades-old offline working methods. Interestingly, many upstart companies, leveraging technological advantages, have outperformed much larger companies whose initially skeptical counterparts and hesitant to embrace technology transformation. Let’s ensure the company you run and cherish doesn’t become one of them. Written by: Eddy Syaifulah.